Peak Oil

PEAK OIL is a term used to describe the point

where demand for oil outstrips supply.

Source: ASPO Australia (Australian Association for the Study of Peak Oil & Gas

http://www.aspo-australia.org.au/

D7a_s1

|

OIL PRODUCTION DECLINE

This

is a modified version of a paper prepared privately for the

Australian Transport Research Forum in Adelaide, 29 September

2004. As a result, this review still shows vestiges of its

transport origins and hence focuses on demand-side rather than

supply-side countermeasures.

D7a_s2 |

Australian

oil production decline

Australia has been

shielded from past oil shocks by our domestic oil production from

Bass Strait. Hence, as a nation we have not learnt as much about oil

conservation and transport planning as European countries, especially

the Netherlands which radically changed its transport planning policy

to reduce its oil dependence after the 1973 oil crisis.

However,

Bass Strait production has been declining since 1985 and until now

other fields have filled the production gap. Reliable recent

predictions by Geoscience Australia and Woodside indicate that

Australia's oil and condensate production will fall substantially in

the next decade (Akehurst (2002), APPEA (2004)).

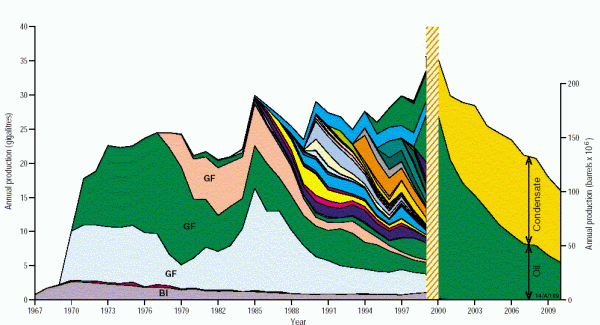

Figure

2. Oil and condensate production profiles of individual Australian

fields, and the forecast cumulative production at 50% probability

derived from industry data, Powell (2001), Akehurst (2002). BI

denotes Barrow Island; GF denotes giant Gippsland Basin Fields.

The

dominance of a few large fields, shown in Figure 2, is typical of oil

regions. The giant fields are normally found first. An increasing

discovery rate of usually progressively smaller fields is needed to

keep production relatively constant as the giant fields decline. Then

inability to keep finding adequate volumes in ever-smaller fields

leads to an overall decline.s becoming increasingly vulnerable to

serious oil shortages, in the short term (within a year), in the

medium term (within 5 years) and in the long term (within one or at

most two decades). Self-sufficiency is expected to decline from an

average of 80-90% over the past decade to about 20% by 2020 (APPEA

(2004))

D7a_s3

World

oil production decline predictions

A

world-renowned US Geological Survey petroleum geologist, Les Magoon,

visited Australia in November 2001 as the Distinguished Visiting

Lecturer of the Petroleum Exploration Society of Australia. He gave

talks around Australia entitled "Are We Running Out of Oil".

As reported (Australian Energy News (2001), Magoon (2001)), he

describes the "Big Rollover" as the change from the current

world oil buyers'-market to a world sellers'-market when global

production starts to decline. Various forecasts have put the "Big

Rollover" date at sometime around 2003, 2007, 2010 or by 2020

(Andrews and Udall (2003)). "At BP, our best estimate of when

global oil shortages will begin to bite deeply is between 20 and 40

years", Greg Bourne, Regional President of BP Australasia, told

the 5th Energy in WA conference in Perth in March 2003.

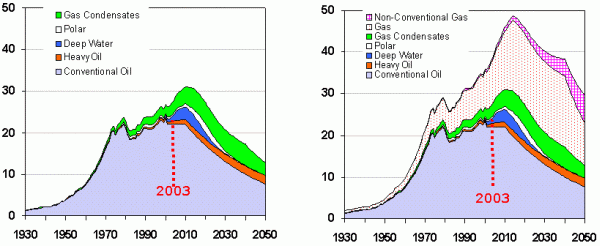

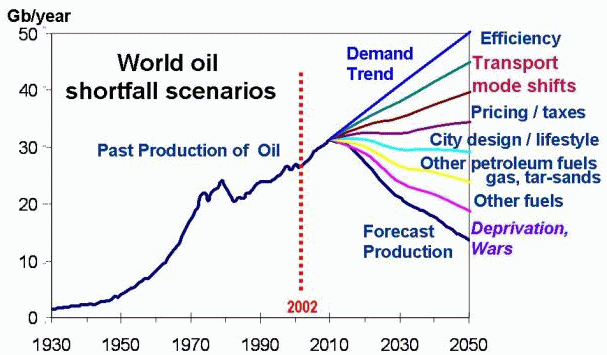

Figure

3a: Current forecast of future world oil production, including

non-conventional oil. (ASPO (2002)). Scale is in gigabarrels of

oil-equivalent per year. The peak of the curve is the “Big

Rollover” Figure 3b: Current forecast of

future world oil and gas production, (ASPO (2002)). The inclusion of

gas does not change the shape of the global hydrocarbon depletion

curve substantially.

Prof. Pierre-René

Bauquis of the French Institute of Petroleum told a combined meeting

of the Society of Petroleum Engineers and the Petroleum Exploration

Society of Australia in Perth that he expected global oil production

to start its terminal decline in about 16 years (Bauquis (2004)). He

does not see any significant renewable energy substitutes for

petroleum over the next 20-50 years. He was also dismissive of

hydrogen as a transport energy carrier and foresaw the use of nuclear

energy to help manufacture synthetic hydrocarbon fuels

As can

be seen in Figure 1, there are some considerably more optimistic

forecasts of future oil supplies. The most optimistic ones are driven

by economic and political perspectives, rather than by geology and

engineering constraints, for example see Lynch (2002). There are very

considerable grounds on which to doubt the forecasts published by the

International Energy Agency. The IEA takes without question the oil

reserve data provided by all the national governments. Many of these

estimates are clearly misleading as they either increase dramatically

without any matching exploration success, or they remain constant for

years in spite of substantial production which must reduce the actual

oil reserves. Conflicting definitions and national and political

priorities make the IEA figures as dubious, for example, as similar

audited and glowing accounts of the financial strength of HIH and

Enron just before their catastrophic corporate crashes.

D7a_s4

Shell

has recently revised its "proven reserves" downward by 23%,

showing that oil-company reserve claims are subject to uncertainties

and mistakes. The scope for analogous errors and

misrepresentation at the national level is very substantial. Mexico

has twice halved its claimed reserves since the mid 1990s. Recent

presentations by Matthew Simmons (Simmons (2004), (2004a)) cast

considerable doubt on the reliability of the claimed Saudi oil

reserve figures. Similar doubts about OPEC's overall reserves are

also raised by Salameh (2004)

In the case of Saudi Arabia, any

substantial errors in reported reserve estimates are of very serious

global significance. There is of course the complementary but lower

probability that some reserves may have been understated, but most

concern has been expressed about over-optimism.

Preparation for Probable Oil Shocks

There is a great deal that can be done to prepare for the likelihood of future oil shocks and hence to ameliorate the effects when (or if) they hit us. Many possible precautions will be "no-regrets" options already justified on equity, environment, health, social or economic grounds. Australia's existing reserves of uncommitted natural gas coupled with local understanding of demand management (especially in water use efficiency and TravelSmart individualised marketing) provide an encouraging opportunity for the nation to both forecast and to weather the coming storms better than many other regions. It is particularly important that the issues be tackled seriously and urgently at all levels in the community. WA Planning and Infrastructure Minister, Alannah MacTiernan (2004) said, in opening the "Oil: Living with Less" conference "It is also certain that the cost of preparing too early is nowhere near the cost of not being ready on time."

Figure 5. An adaptation of the scenario outlined by Swenson (1998) of the various mechanisms of bridging the coming gulf between growing current world demand for oil and the forecast decline in the production of conventional oil (Robinson (2002)).

D7a_s5

Communication

about potential solutions and their limitations

It

will be crucially important that there be open and informed

discussion about oil depletion. Broad consideration of the various

strategies for reducing our oil vulnerability; especially their

limitations and the input energy needed, the time required and the

costs needed to implement them are essential precursors to effective

decision-making.

Contrary to many common predictions, it is

highly unlikely there will ever be a single "Magic Bullet"

panacea for our oil vulnerability. A major aim

should be to reduce our very high levels of automobile dependency.

Some of the possible oil-use reduction and replacement strategies are

outlined above in Figure 5.

Travel

mode shifts: Individualised Marketing

Very

substantial changes have already been triggered in existing urban

travel patterns when people are given personalised information about

the travel choices available to them. Empowering people in this

way has resulted in sustained decreases of 8% to 19% in car-kms

travelled. The oil saved by these voluntary travel pattern changes is

very significant, and shows that reducing car-travel demand is more

cost-effective than exploring for more oil.

Australia

leads the world in the application of Individualised Marketing to

make very significant reductions in car travel rates. Programmes have

been completed or are underway in several states. WA has the most

extensive record with a number of very successful and well documented

programmes. The average reduction in car-kms travelled in the

completed WA projects is 13% at a benefit:cost ratio of 30:1, far

higher than those of most transport projects. Similar results have

been obtained in Europe and the US, (Robinson (2004), Socialdata

(2004)).

The TravelSmart Individualised Marketing

programmes in WA have covered suburbs with some 158,000 people to

date, and have resulted in the annual saving of some 115 million

car-kms, or 11 million litres of petrol (John (2004), MacTiernan

(2004)). Extrapolated to Australia's urban population, this would

equate to about a thousand megalitres of oil saved each year.

Globally, this level of travel reduction and mode shift would save

each year oil amounting roughly to the annual production of Iraq, as

an example.

Alternative

Fuels

All

alternative fuels to replace petrol and diesel have severe

constraints to their introduction. Enormous volumes are required to

replace a sizeable proportion of our current liquid fuel usage, and

the timescale for their provision in these volumes is very short. For

instance, diverting Australia’s entire wheat crop to produce

ethanol would replace less than 10% of our oil usage. Hydrogen is an

energy carrier, not an energy source. It requires large amounts of

energy for its manufacture and for its distribution. For the

foreseeable future, the vast bulk of the world’s hydrogen will

continue to be made from oil and gas. The ‘Hydrogen Economy’

may well turn out to be just a pipe-dream like fusion power.

Concentration on hydrogen diverts attention and resources from

practical and immediate fuel conservation options. The most likely

alternative for our current cheap plentiful oil will also be oil, but

much more expensive and less plentiful oil.

D7a_s6

Technological

changes

It will be

very risky indeed to rely on unproven technologies becoming available

on such enormous scales within a decade or so, which is the timeframe

likely to be required if the Big Rollover forecasts are accurate.

There are around 14 million motor vehicles in Australia, and at only

$25,000 each, a fleet replacement exercise to change them to other

technologies or other fuels would need the outlay of $350,000

million, which would be diverted from other community and Government

needs. Currently half the registered motor vehicles are more than ten

years old, and 20% more than 20 years old. Normal fleet changeover

rates are actually very slow. Half of today's new cars will still be

on the roads in 20 years (BTRE (2002))

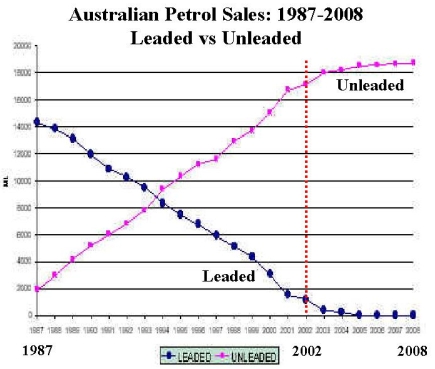

For instance, it has

taken Australia almost two decades since 1985 to switch from leaded

to unleaded petrol (Figure 6), a very much simpler technological

change indeed than a conversion to fuel-cell cars, for instance. This

change was mandatory for all new cars purchased from 1st January

1986.

Figure

6. Example of the inevitably slow rate of introduction of new

technology into Australia's vehicle fleet. Unleaded and leaded (or

LRP) petrol sales, Australia, from 1987 and extrapolated to 2008,

(Australian Institute of Petroleum at www.aip.com.au), following

mandatory introduction of emission-control engines in new cars in

1986. The introduction of hybrid vehicles and fuel cells is likely to

be much slower as the technological differences are much greater.

Plug-in hybrid and electric car technology is available and feasible today (see electric cars display), but we need to show to the car companies that there is a strong demand for electric cars!!!

Please go to your local car dealer and register your interest for a plug-in hybrid or electric car.

D7a_s7